Making the decision to purchase a house is a big step. First-time buyers are making the move from renting or living with family to having property that’s all their own. It’s also a significant expense for most people, so take all the time that you need to make your choice.

Some buyers are concerned about the tax implications of acquiring real estate. We all know that home seller are concerned about capital gains taxes from the sale. There are also certain taxes that home buyers need to be aware of.

Buying a home in Utah can take time. Even if you have a highly motivated seller, it can still take several weeks or months for the transaction to be completed. Specific steps must be taken that can extend the process. You may also encounter unexpected delays or other problems. Patience, persistence, and a proactive plan of action can help you achieve your goal.

Here are some of the common tax aspects that are associated with buying a house:

1. Transfer taxes.

Transfer taxes are traditionally charged to convert the home’s title from the seller to the buyer. However, Utah is one of twelve U.S. states that currently does not charge any transfer taxes. Homeowners there won’t have to worry about this additional expense.

2. Local and state taxes.

First-time home buyers in Utah can claim a tax credit for up to $2,000 per year for as long as they own their mortgage loan. This is accomplished by turning a portion of their mortgage interest deduction into a tax credit. It can be an added incentive for interested parties who may qualify for a larger home loan than they may have originally anticipated.

3. Mortgage interest.

Any mortgage loans that were obtained after 2017 are also eligible for deductions. The maximum total amount that can be claimed is $750,000. This applies to primary residences, second homes, vacation homes, and rental properties all at the same time. The exact amount of mortgage interest paid for a given year will be indicated on your 1098B form.

Some home buyers who have lower annual income than average may be able to take a mortgage interest credit on their taxes. A Mortgage Credit Certificate is mandatory for this kind of exemption. Your respective local state or government offices will assign this certificate and can help you find out if you meet the qualifications.

If approved, this credit is a dollar-for-dollar amount match. You can lower your tax amount based on the percentage listed on your certificate. The percentage can be anywhere from ten to fifty percent. Form 8398 will be necessary if you’re claiming this deduction. Homeowners that meet the mortgage interest credit standards can take a mortgage interest deduction. All they need to do is to reduce the mortgage interest deduction by the same amount as the mortgage interest credit that was deducted.

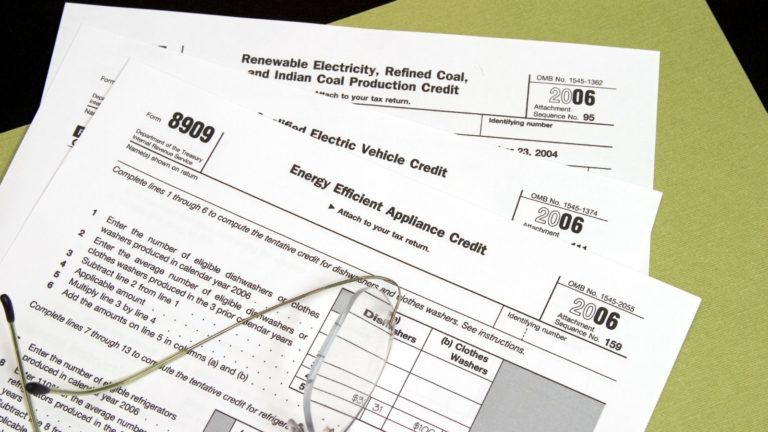

4. Energy credits.

Certain energy-efficient appliances and upgrades can lower your tax bill. The amount will vary according to the installation date. You can claim up to $1,200 of those expenses for any energy-efficient solar water heaters or electric equipment that was added to your house in 2021, and up to $800 for the same types of installations that were completed in 2022.

5. IRA payouts.

Some home buyers may choose to take funds from their individual retirement accounts (IRAs) to help pay their down payment. Buying or building your first home allows you to take out as much as $10,000 from such accounts without any penalties. This rule doesn’t apply to 401k accounts and the money has to be used to buy or build a new residence within 120 days from when they were taken out of the IRA.

6. Home offices.

Some costs for office space in your new home may be deducted as well. Most of these exemptions are restricted to self-employed individuals. They can claim a deduction of $5 per every 300 square feet of home office space. The home office must be used on a regular basis, and cannot also be a spare bedroom, game room or serve any other purposes at the same time.

7. Property taxes.

People who live in areas of Utah that are typically known for higher property taxes could see some relief. Deductions of up to $10,000 can be claimed annually. This can only be applied to the property taxes that were paid for that particular year. Previous years’ property tax payments can not be included in this exemption.

8. Mortgage points.

Mortgage points are additional amounts that are paid to obtain mortgage loans. Lenders may refer to these costs as discount points, loan origination fees, loan discounts or maximum loan charges. The total dollar value of the points that were taken out could be subtracted from your taxes, as long as the following conditions apply:

- The mortgage points were identified on the settlement statement.

- Your primary residence is being financed by the mortgage loan in question. It could be used to build a new house or purchase an existing property.

- The bank, credit union or other lending institution determined the point amount as a certain percent of the principal for the mortgage loan.

- You didn’t pay more than the current rate for points in your area.

- Paying mortgage points is common practice in the state or region that you live in.

- The dollar amount spent on points must be at least equal to the down payment and closing costs that were paid in cash (along with any points that were paid by the home seller). The funds can’t have been borrowed from your lender or another similar organization.

- The points weren’t used to replace property taxes, attorney fees, title or escrow company fees, appraisal fees, inspection fees, or other related costs that would appear as individual items on the settlement statement.

- The cash method of accounting is being used. All expenses are deducted during the year in which they were paid and income is recorded in the year that it was earned.

Failure to meet the conditions listed above will result in deducting the total mortgage points as prepaid interest. This can be done over the life of the home loan. They don’t have to be subtracted all at once.

Conclusion

If you have any questions or concerns about these taxes, discuss them with your financial consultation, accountant or tax preparer. They should be able to examine your paperwork and tell you what you’ll be responsible for. Keep good records of all expenses and retain a copy of your loan documents for your records.

Taxes aren’t fun, but they’re a necessary part of becoming a homeowner. Once you’ve fulfilled those obligations, you can relax. It’s time to start enjoying many wonderful days and nights with loved ones in an amazing house for many years to come.

Contact Jackie Ruden Realty Team

Give us a call today at (435) 272-7710 to set up a time to discuss your current and future real estate goals in regards to buying a home or buying a property in trust. We look forward to working with you to make your goals a reality.